How invoice financing can help importers in the United States

December 28, 2022

The hyper-competitive imports market in the United States

American culture is commonly portrayed as one centred around consumerism. This image may be rooted in objective reality: The United States is the number one importer in the world. In 2021 alone, the United States imported US$3.4 trillion in goods. Among the most popular categories were industrial, automotive, food and beverage, consumer, and capital goods.

American imports, in short, are a booming business. While the success of this industry as a whole is beneficial for the nation as a whole, it presents a challenging business environment for individual importers. Take the example of an importer of apparel. In a smaller market, the importer would have significantly less competition, so they would have greater leverage in negotiating terms with exporters.

In the United States, however, there may be hundreds, if not thousands of other importers in your city alone. These importers implicitly compete with their peers on price, volume, and other factors when negotiating with exporters.

In a hyper-competitive business environment like this one, American importers should search for every possible advantage. Because it would be difficult to continually negotiate with exporters – if you are not willing to buy their products on market standard terms, another importer will – it’s crucial to seek competitive advantages through other channels.

One such example is the opportunity presented by invoice financing platforms. These invoice financing platforms can provide numerous benefits to American importers. The most obvious is more favourable payment terms, but the use of an invoice financing platform can also provide deeper more strategic benefits.

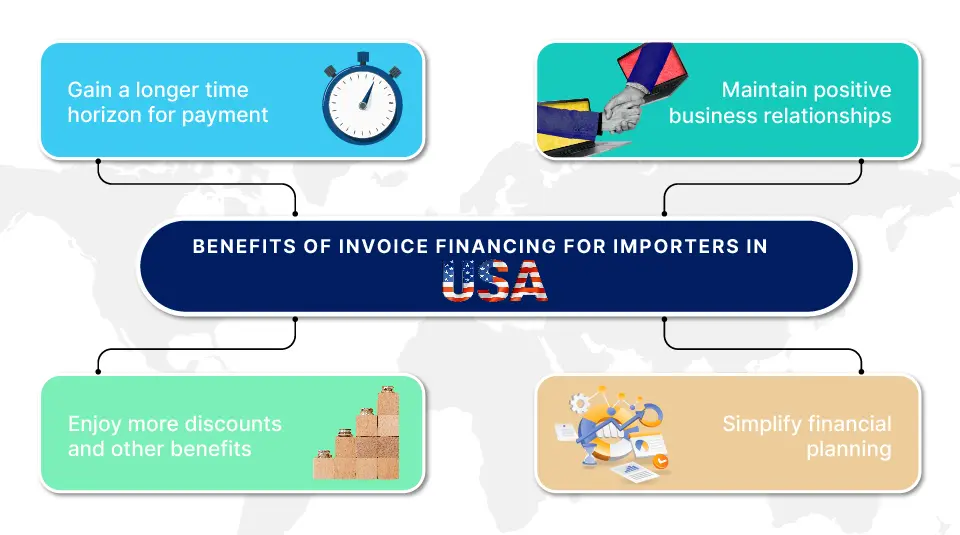

The benefits of receivable financing for importers in the United States

Gain a longer time horizon for payments

The terms between each trade deal of an importer and exporter may vary. After the exports are shipped to an importer, the latter may have anywhere from 2 weeks to 90 days to pay the balance, depending on what was negotiated between the two parties. An invoice financing platform can dramatically extend this runway all the way up to 120 days.

Achieving this runway is also easy. All the American importer has to do is upload the exports receivable that they want to be paid. The invoice financing platform will pay the partner exporter immediately, and in turn, the importer will have a full 120 days to pay back the provider.

By enjoying more favourable payment terms, the importer gains significantly more working capital. This working capital can be used for more revenue-generating activities, such as importing more products with the importer, striking deals with other importers, or even investing into its sales and distribution network in the United States. The invoice financing platform enables not only better payment terms, but greater business results.

Maintain positive business relationships

Importers and exporters often have conflicting goals. Importers want to extend payment terms as much as possible, while exporters want to shorten them. Importers want to get their goods immediately, while exporters want to ship them out only after receiving some type of payment. Importers want to delay paying a balance as long as they can, while exporters want to collect as soon as they can.

These conflicting wants often strain a business relationship. When an importer regularly delays payment out of necessity, sometimes even beyond the agreed-upon terms, the exporter may write off that business as a bad payer. If delayed payments happen often enough, which is a common case, given that importers need to manage their cash flow as well, exporters may seek corrective action.

In dealing with a bad payer, the exporter may limit the volume and type of products they send to the exporter, or even choose to cut them off altogether, refusing to do further business. This type of strained or failed B2B relationship with exporters will affect the business continuity of the importer, who will now have to search high and low for another importer who can address the same product gap, a feat that may be difficult depending on the product.

With invoice financing, in contrast, an importer will never have to go through the rigamarole of alienating an exporter. Because the exporter receives payment quickly for every export receivable by the invoice financing platform, the importer maintains positive relationships with the business leaders and collections team of the exporter. As a result, both parties can focus entirely on addressing the trade gap the imported products fill.

Enjoy more discounts and other benefits

When thinking about invoice financing, importers tend to overlook how these platforms will help exporters, which will also ultimately benefit them. Most importers in the United States do business with exporters in the Global South, in countries such as India, Bangladesh, Malaysia and Vietnam. These countries are emerging markets, and the exporters operating from them tend to be micro, small, and medium-sized enterprises (MSMEs).

In the current legacy system, MSMEs struggle with cash flow. Although they tend to send out products as soon as an order is received, they may not be paid for up to 120 days. As a result, the working capital of exporters is always fluctuating, and it’s difficult to make strategic plans that grow the business, as that requires a steadier cash flow.

Invoice financing platforms help these exporters. After shipping out their goods and uploading their export receivables to the invoice financing platform, the business can have cash in the bank in as little as 48 hours. The exporter will be paid as much as 90% of the face value of the export receivable, with the invoice financing platform taking a small fee for its role.

Because these exporters can now control when they are paid, they can more easily plan, invest, and execute business activities that grow the business. For example, with the additional capital, an MSME can purchase raw materials in higher volume, diversify its product offerings, or even invest in equipment or infrastructure that will drive greater efficiencies.

When the exporter in the Global South grows into a larger business, they have more to offer their partner importers in the United States. These benefits include everything from discounts on imported products to a greater selection to choose from. Invoice financing, in short, does not only work in the favor of the American importer: It helps the exporter grow to the point that it can offer even more value to their trading partners in the United States.

Simplify financial planning

As mentioned earlier, the terms vary wildly without an invoice financing platform. Depending on negotiations, importers may have very different payment terms with each of their suppliers. Some might be 14 days, 30 days, 60 days, 90 days, 120 days, and every number in between. This variability of payment terms is not only difficult to track (the standard terms of each importer will need to be documented somewhere), but it makes financial planning chaotic.

When payment terms have such high variability, the finance team needs to be laser-focused on accounts payable on a weekly basis, balancing the need to maintain working capital with the need to meet exporter payment terms. This function is resource-intensive, taking valuable time away from finance officers that could otherwise be spent on more valuable business activities.

Invoice financing alleviates finance teams of this burden. When payment terms are standardized to a universally set 120 days, finance teams can necessarily spend less time scrambling on accounts payable on a week-to-week basis. Their payment cycle, after all, now runs on a 4-month cadence. With the time saved and the working capital gained, finance teams can permanently take a longer-term view of their organization’s financial planning. They can focus on deploying the capital to the mid-to-long-term business activities that will grow the organization.

Choosing invoice financing as an importer in the United States

While the United States is the foremost economy for importing in the world, this economic climate presents key challenges for individual importers. As there are only so many trade-offs that importers can negotiate with their partner exporters, importers need to seek more innovative solutions in order to more successfully complete.

Invoice financing, in particular, gives importers a longer payment horizon, which strengthens their relationship with exporters, makes it easier to plan revenue-generating business activities in the medium- to long-term, and even opens the door to discounts and other benefits, as their partner exporters can also more easily grow when the platform pays them immediately. Clearly, invoice financing should be an option for importers in the United States who wish to innovate.

Embarking on any new initiative – even one as beneficial as invoice financing may be, is always daunting. To make this easier for importers, Incomlend has proudly partnered with CMA CGM, a leading shipping group that operates in 420 ports across 160 countries using 257 shipping routes. As part of this partnership, Incomlend offers special rates to any of CMA CGM’s clients. This offer is meant to make it easier for enterprises to experience first-hand the value that invoice financing can bring to their organization.