Tech-Enabled Platform

for Our Clients

Take your cash flow to the next level with Incomlend Invoice Financing Marketplace

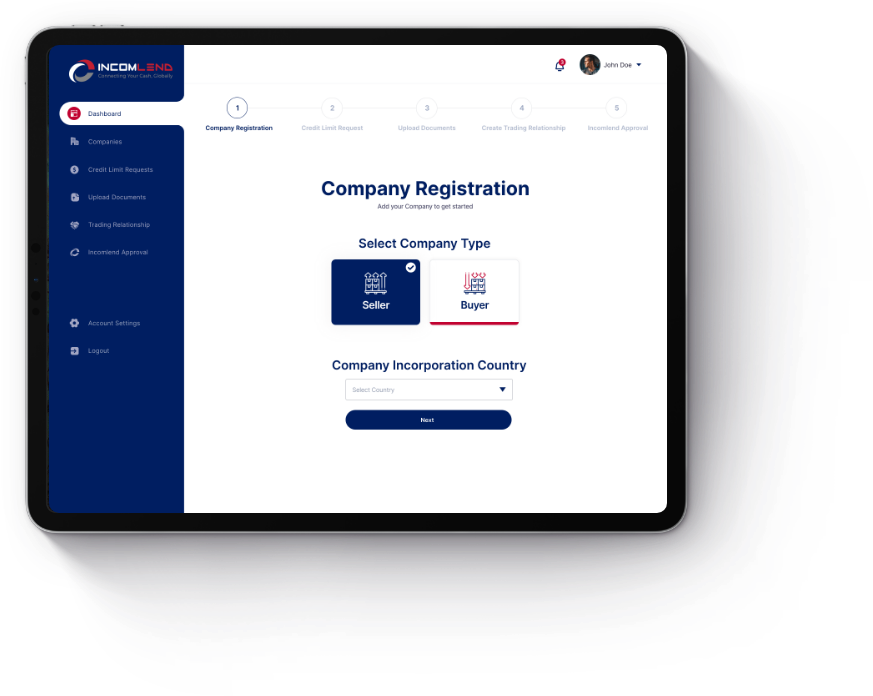

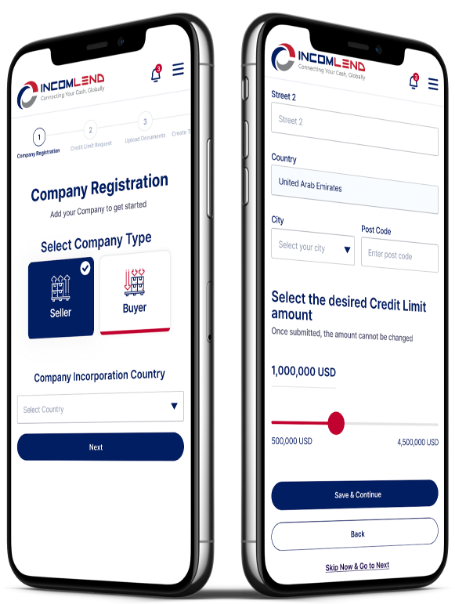

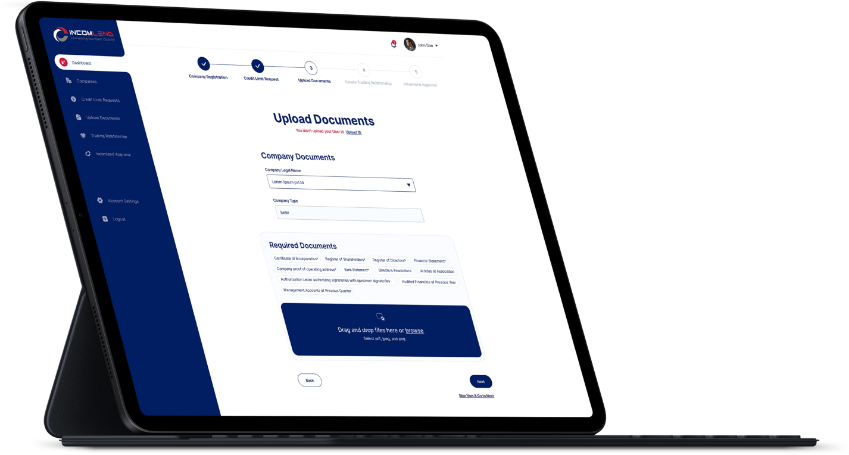

Incomlend provides invoice financing on an intuitive and easy-to use online platform. The platform provides fast and flexible working capital solutions, enabling exporters and importers to manage their working capital needs.

Diligent Onboarding Process on Our Platform

Through our intuitive and easy-to-use online platform, you can finance directly to businesses worldwide. You will earn steady and stable returns while helping them access working capital to accelerate their business growth.

You can take a hands-on approach to invoice investing on our cross-border platform, directly on the platform with capital held on Trustee secured escrow accounts in Singapore. Allocate your capital to individual invoices or to groups of invoices that meet your preferences. You can build your unique invoice trading strategy.

We have a well-diversified portfolio of high-quality invoices. The Luxembourg-domiciled fund is actively managed by our experienced team.

We provide investors with steady and stable returns that are uncorrelated with financial markets. Due to our robust risk management processes, we aim for very low volatility and minimal downside.